In the second quarter of 2014, the Chinese smartphone industry's shipment volume reached 104.2 million units, up 17% sequentially, with a total number of 560 models launched during the quarter, according to MIC (Market Intelligence and Consulting Institute). Over 85% of the smartphones sold in China were low-cost models with a price tag below 2,000 RMB (US$325.7; US$1=6.141 RMB). With the Chinese government's issuance of 4G LTE licenses to telecom operators, 4G-capable smartphones had been gaining steam, taking up around 25% of all smartphones shipped in the past three months ended in June.

Rising Chinese Brands Outpace Samsung

In terms of vendors' shipment volume, Xiaomi leapfrogged its rivals into the leading position by shipping nearly 15 million smartphones in China during the second quarter. Trailing by a narrow margin, Lenovo, Samsung, and Coolpad each shipped almost 13 million units, and was ranked the second, third, and fourth, respectively. As Samsung used to lead the Chinese smartphone market by a huge margin, the fact that Chinese branded vendors had outdone Samsung is a proof to show that Chinese consumers have shifted their focus from renowned brands to products with higher cost-performance ratio.

It is also worth noting that the share of telecom operators' custom-made models was on the decline, indicating the growing influence of traditional distribution channels and online sellers on the open market. Xiaomi is one of the successful stories of online smartphone sellers while BBK (VIVO) and OPPO, both witnessed rapid growth in shipment share in the second quarter, rely on conventional sales channels to sell smartphones featuring mid-tier to high-end specifications with a price tag between 1,500 RMB to 2,000 RMB (US$244.3 to US$325.7).

Despite a close margin in their shipments, Chinese brands, such as Xiaomi, Huawei, Lenovo, Coolpad, ZTE, BBK, and OPPO have been on the rise. Back in 2013, the biggest domestic players in the Chinese market were Lenovo, Huawei, Coolpad, ZTE, whose emergence were largely attributed to their contract manufacturing business for telecom operators' custom-made models. Today, former contract manufacturers (Lenovo, Huawei, Coolpad, ZTE), online seller (Xiaomi), and brands relying on conventional sales channels (BBK and OPPO) all have established their foothold in the Chinese market. This trend has shown that the market is concentrating toward vendors who have distinctive features. For example, BBK and OPPO have launched large-scale marketing campaigns to promote smartphones having mid-range to high-end specifications; Huawei are packing its high-end phones with Hisilicon processors as a unique selling point; Xiaomi is extending its reach from online platform to custom-made models for telecom operators. In short, Chinese smartphone brands are seeking to create differentiation in order to prepare for the fierce competitions in the future.

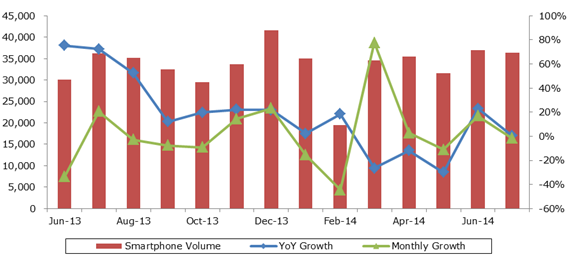

Chinese Smartphone Shipment Volume, June 2013 - July 2014

Source: MIC, September 2014

Qualcomm, MediaTek Dominate over 80% of the AP Market; Leadcore, Spreadtrum See a Dramatic Plunge in Shipments

With China Mobile launching TD-LTD network in the beginning of this year, China Mobile, China Unicom, and China Telecom are expected to acquire over 200 million LTE-supported smartphones. Since Leadcore and Spreadtrum could not satisfy the need for LTE-enabled and 64-bit chipsets, both companies had seen considerable decline in shipments. In contrast, Qualcomm and MediaTek had prevailed in the value-line and mid-tier segments. MediaTek managed to secure Xiaomi's Redmi orders with its MT6582 (a successor of MT6589) and the octa-core MT6592 chipsets. Meanwhile, Qualcomm lowered the price of its Snapdragon 400 series chipsets to obtain Xiaomi's Redmi Note orders and ate away some of MediaTek's share in the value-line and mid-range segments. In the second quarter of 2014, Qualcomm had a lion's share of the AP (application processor) market in China.

Hisilicon, who has been focused on high-end processors, took up around 10% of Huawei's overall shipments in 2013. However, thanks to Huawei's Honor series smartphones, Hisilicon had a chance to raise its share by rolling out Kirin 910 and 920 processors. It is therefore projected that smartphones packed with Hisilicon's processors as a percentage of Huawei's total shipments will surge to 20% to 30% by the end of 2014.

Looking ahead to the second half of 2014, as Qualcomm's royalty issues remain unsettled, some smartphone vendors are likely to adopt MediaTek's total solutions in order to save royalty expenses. In addition, major Chinese telecom operators' subsidy plans for 4G-supported phones will be concluded in September. Both factors are expected to stimulate MediaTek's shipments in the third and fourth quarter.

To see more about this report, please visit: The Chinese Smartphone Industry, 2Q14.

For future receipt of press releases, or more information about MIC research findings, please contact MIC Public Relations.

About MIC

Market Intelligence & Consulting Institute (MIC), based in Taipei, Taiwan, was founded in 1987. MIC is Taiwan's premier IT industry research and consulting firm providing intelligence, in-depth analysis, and strategic consulting services on global IT product and technology trends, focusing on markets and industries in Asia-Pacific. MIC is part of the Institute for Information Industry. https://mic.iii.org.tw/english